1. Introduction to optical modules

1.1. Definition of optical module

An optical module is a device used in optical communication, which includes a light emitter and a receiver. It can convert electrical signals into optical signals and send them to remote devices, or convert received optical signals into electrical signals and pass them to computers, routers, or switches. Optical modules are commonly used in data centers, enterprise networks, telecommunications operator networks, and other fields to achieve high-speed, long-distance, and high-reliability communication.

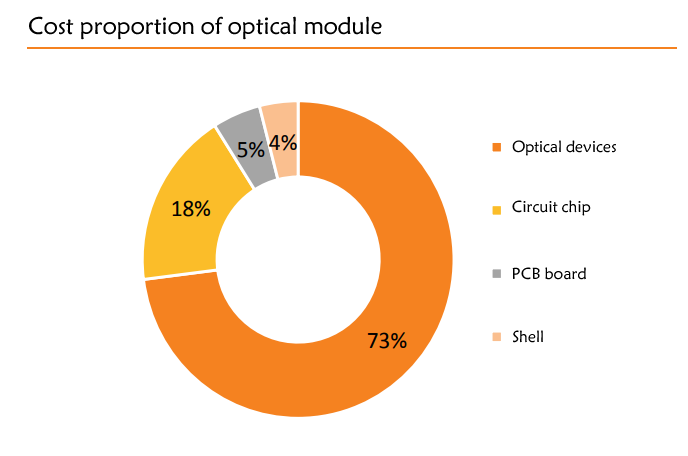

1.2. Cost structure of optical modules

The core component that implements the optoelectronic conversion function in optical modules is the optoelectronic chip. The optical chip is the direct chip that completes the optoelectronic signal conversion in optical modules, while the electrical chip is the supporting component that enables the operation of the optical chip. Both are core components of optical modules. In terms of cost ratio, optical chips usually account for 40%-60% of the cost of optical modules, while electrical chips account for 10%-30%. The main upgrade of optical modules is in speed, and the cost of optical communication chips increases with the continuous increase in the speed of optical modules. As the main cost component, the difference in chips has become the main criterion for measuring the high-end and low-end of optical devices. The higher the speed and higher the end of the optical module, the higher the cost ratio of optical chips and electrical chips.

1.3. Upstream and downstream of the optical module industry chain

The upstream mainly includes suppliers of optical chips, electronic chips, optical devices, etc. Among them, there are many suppliers of optical devices, with a high localization rate. However, the chip process technology barrier is high, and the research and development cost is high. Foreign large factories occupy the majority of the market share in the high-end optical chips and electronic chips field. The optical module is located in the midstream and belongs to the packaging stage with relatively low technical barriers. Downstream includes Internet and cloud computing enterprises, telecom operators, data communication and optical communication equipment manufacturers, etc. Internet and cloud computing enterprises and telecom operators are the end users of optical modules.

The domestic manufacturers of optical chips mainly compete in products below 25Gb/s, and the localization rate of products above 25Gb/s is still insufficient. According to the speed, optical chips are generally divided into 2.5Gb/s, 10Gb/s, 25Gb/s and above various modulation rates. According to the function, optical chips can be divided into laser chips and detector chips. The laser chip is used to transmit signals and convert electrical signals into optical signals. According to the light emission structure, it is further divided into surface emitting chips and edge emitting chips, mainly including VCSEL, FP, DFB, EML; detector chips are used to receive signals and convert optical signals into electrical signals, mainly including PIN and APD. In 2022, the highest speed of large-scale commercial EML has reached 100Gb/s, and the highest speed of large-scale commercial DFB and VCSEL laser chips has reached 50Gb/s.

European, American and Japanese optical chip manufacturers have the advantage of technological experience, gradually realizing industrial closed-loop and establishing high industry barriers. They have the technology to mass produce optical chips with a speed of 25Gb/s or above. Domestic manufacturers have not yet mastered epitaxial technology in chip manufacturing, so high-end epitaxial wafers mainly rely on imports, which restricts their development. From the perspective of market speed, domestic manufacturers are currently able to mass produce 2.5Gb/s and 10Gb/s laser chips, while only a few manufacturers achieve mass shipment of 25Gb/s laser chips. Most manufacturers of 50Gb/s and silicon light solutions are still in the stage of verification and trial production.

The localization rate of electronic chips is low, and the core suppliers are still mainly overseas companies. Electronic chips include laser driver chips LD Driver, transimpedance amplifier chips TIA, limiting amplifier chips LA, DSP electronic signal processing chips, etc. However, only a few domestic suppliers are involved in the production of electronic chips with speeds of 25Gb/s and below, and those above 25Gb/s are basically imported.

1.4. Optical module industry landscape

In recent years, domestic optical module manufacturers have developed rapidly, and the industry has shown a trend of "western retreat and eastern advance". Since 2010, domestic optical module manufacturers have developed rapidly and gradually moved up in the global ranking. In 2010, only one domestic company, Wuhan Telecommunications Device Co., Ltd. (WTD), was listed in the top 10 list worldwide. In 2022, according to LightCounting's global Top10 list, China's domestic manufacturers became stronger and stronger, with a total of seven companies listed, of which Innolight and Coherent ranked first. From 2015 to 2023, the monthly export scale of optical modules fluctuated upward, and in November and December of 2023, it set new highs continuously. According to customs export data, from 2015 to 2023, the annual compound growth rate of China's optical module exports was 12.26%, with a clear upward trend. In 2023, it showed a trend of low in the front and high in the back, mainly due to the gradual increase in overseas orders for high-speed products from domestic leading manufacturers in Q2 and Q3, which drove the growth of export demand.

2. Overview of the optical module industry

The global optical module market size will achieve a CAGR of 12% from 2022 to 2028, and is expected to exceed US$20 billion in 2028. According to Yole Intelligence data, the global optical module market size was US$11 billion in 2022. Driven by the high demand for 800G high-speed data rate modules from large cloud service operators and the demand for increasing fiber network capacity from national telecommunications, it is expected to increase to US$22.3 billion in 2028, with a compound annual growth rate of 12% from 2022 to 2028. The domestic market demand for optical modules is US$2-3 billion, accounting for about one-fourth of the global market. According to LightCounting, China's optical module deployment will account for 25%-35% of the global market from 2018 to 2023, and 20%-25% from 2024 to 2029, with a slight decrease. The aggressive plan of North American cloud service providers to deploy 800G in AI clusters will become the main factor for China's share to decline in the next two to three years.

2.1. The capital expenditure of telecommunications market operators is stable and growing, with the proportion of expenditure tilting towards the network of computing power

In the telecommunications market, since the announcement of commercial 5G services in 2019, the capital expenditures of the three major telecommunications operators have shown a steady growth trend. In 2019, the total capital expenditures of the three companies were approximately 299.9 billion yuan, and it is expected that the total capital expenditures will be approximately 359.1 billion yuan by 2023, with an annual compound growth rate of 4.61%. In 2019, it was the first year of 5G network construction, followed by the peak period of 5G development in 2020-2022. On June 6, 2019, the Ministry of Industry and Information Technology issued commercial licenses for 5G to the three major operators and China Radio and Television. In the same year, the first batch of 150,000 5G base stations were built and launched. From 2019 to 2023, an average of 675,400 new 5G base stations will be added each year. The optical module in the field of 5G is used in pre-transmission, mid-transmission and back-transmission. The pre-transmission mainly corresponds to 25G/50G optical modules, the mid-transmission mainly corresponds to 50G/100G optical modules, and the back-transmission mainly corresponds to 100G/200G/400G optical modules.

The three major telecom operators are gradually increasing their investment in industrial Internet and computing network. In 2023, China Mobile is expected to achieve a capital expenditure of 183.2 billion yuan, of which 45.2 billion yuan will be spent on computing power and network capital, a year-on-year increase of nearly 35%. More than 240000 cloud servers will be added and over 40000 IDC racks will be available for external use. China Telecom is expected to achieve a capital expenditure of 99 billion yuan in 2023, with a 40% increase in industrial digital investment, including 19.5 billion yuan in computing power investment and 9.5 billion yuan in IDC investment. China Unicom's computing power network will account for 16.8% of its capital expenditure in 2022. The company expects its computing power network capital expenditure to reach 14.9 billion yuan in 2023, accounting for 19.4% of its total capital expenditure, with a year-on-year growth of over 20%.

2.2. High capital expenditure and network architecture upgrades have become the core driving forces for boosting the prosperity of the data communication market

The four major cloud service providers in North America account for about 85% of global capital expenditure, with a compound annual growth rate of 30.77% from 2019 to 2022. According to Counterpoint Research data, the four major cloud service providers in North America, Microsoft, Amazon, Google and Meta, will account for 85% of the total global capital expenditure in 2023. The overall capital expenditure slowed down in 2022, which may be attributed to the global economic downturn caused by the COVID-19 pandemic, but it has gradually picked up since Q2 of 2023.

The expansion of global data scale has accelerated investment in data center construction, and internal equipment in data centers requires network interconnection, which corresponds to a large demand for optical modules. With the continuous development of communication and Internet applications, the demand of individuals and enterprises for computing power and data storage is gradually migrating to the "cloud". The latest data from IDC shows that the global data scale will increase from 103.66ZB in 2022 to 284.3ZB in 2027, with a compound annual growth rate of 22.36% from 2022 to 2027. We believe that the increase in data scale requires more servers and switches, which require information exchange and network interconnection, resulting in a large demand for optical modules. Statista estimates that the global number of hyperscales has increased from 259 in 2015 to 700 in 2021, and the latest data from Synergy Research Group shows that this number has approached 900 in 2023, accounting for 37% of all data centers worldwide. According to Priority Research data, the global hyperscale market size in 2022 was $80.16 billion, and it is expected to increase to $935.3 billion by 2032. The annualized compound growth rate from 2023 to 2032 will reach 27.9%.

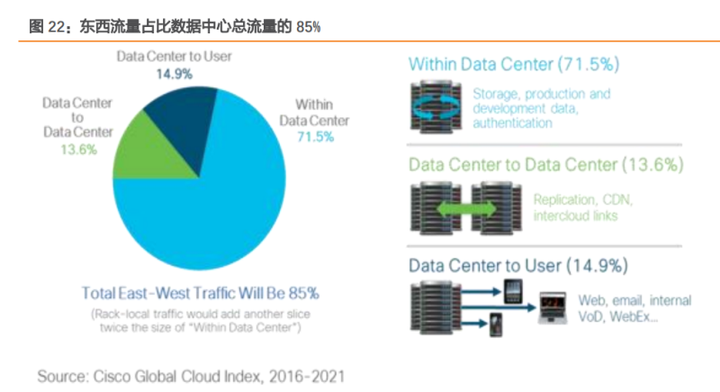

The spine network architecture greatly increases the demand for optical modules, which helps optical modules to iterate and upgrade towards higher speeds. The traffic in data centers is divided into two types: 1) north-south traffic: the traffic between clients outside the data center and servers inside the data center; 2) east-west traffic: the traffic between different servers inside the data center. Cisco's data in 2021 shows that east-west traffic is the main type of data center traffic, accounting for up to 85%.

In the traditional three-layer topology network architecture, east-west traffic must be forwarded through the aggregation layer and core layer devices, passing through many non-essential nodes, resulting in slower response time for end users. In contrast, the Spine-Leaf architecture's flat design can distribute east-west traffic over multiple paths, making it more suitable for use in scenarios with large east-west traffic. Further discussion, the interconnection between spine switches and leaf switches requires a reasonable bandwidth ratio to match, and its uplink should always run faster than the downlink to avoid port link congestion. Therefore, while deploying more optical modules, the Spine-Leaf architecture also places higher requirements on optical module speeds.

2.3. AIGC drives the demand for computing power, and the "barrel effect" accelerates the iterative upgrade of high-speed optical modules

On November 30, 2022, the release of ChatGPT, a model under OpenAI, triggered a global arms race. On November 30, 2022, OpenAI released the big language model ChatGPT. CEO Sam Altman announced that ChatGPT users had surpassed 1 million in just 5 days, and by the end of January 2023, the number of ChatGPT users had exceeded 100 million, making it the fastest-growing consumer application in history. The rise of ChatGPT has led multiple AI companies around the world to release their own models, with overseas Google launching the PaLM2 model, Meta releasing LLaMA-13B, and Microsoft creating New Bing based on ChatGPT; Baidu took the lead in releasing ERNIE Bot.

Taking ChatGPT as an example, the behind of model upgrade and iteration is the training and reasoning of massive data. Since 2012, the global demand for computing power has experienced rapid growth. The model parameters and pre-training data size of GPT-1 are 117 million and 5GB respectively, which has increased to 175 billion and 45TB by GPT-3. It is expected that the parameter size of GTP-5 will be 100 times that of GTP-3, and the required computing power will be 200 to 400 times that of GTP-3. With the continuous upgrade and iteration of models, the required data volume is also growing rapidly in multiples. According to the analysis report "AI and Compute" released by OpenAI, since 2012, the demand for computing power for AI training applications has doubled every 3-4 months, and from 2012 to now, AI computing power has increased by more than 300,000 times.

The application and development of AI have a "cask effect", and the computing power cluster requires network interconnection and synchronization matching, which accelerates the development of high-speed optical modules and optical cores in the field of AI. The core of computing power is AI chips, among which GPUs are good at parallel and repetitive calculations, and are widely used in the field of AI. AI chips provide computing power and carry algorithms, which are the physical carriers for realizing artificial intelligence, and are also the commanding heights of competition in the field of AI. Common AI chips include three types: general-purpose (GPU, DPU), semi-custom (FPGA) and fully-custom (ASIC), among which GPUs are more mature in commercialization. However, there are many types of AI chips developed with FPGA and ASIC architectures, which are still in the stage of development and exploration. According to IDC data, GPUs have the highest utilization rate in China's AI chip market in 2022, accounting for 89% of the market share and reaching 6 billion US dollars. The data exchange between computing power server clusters requires network interconnection within the data center to stimulate a large demand for high-speed optical modules. The huge training task of models requires a large number of GPU servers to provide computing power, and these servers need to exchange massive data through network connections, which requires higher-speed optical modules for matching. In March 2022, NVIDIA launched DGX H100, and the demand for 400G and 800G optical modules was triggered accordingly. Due to different networking methods, it is difficult to accurately calculate the relationship between GPU and optical module usage ratio. We take NVIDIA DGX H100 server cluster as an example to calculate: 1) In the computing network, each single H100 corresponds to 1.5 800G optical modules and 0.9 400G optical modules; 2) In the storage network, each single H100 corresponds to 1.25 400G optical modules. Assuming only considering the demand for optical modules in the above two network scenarios, each single H100 corresponds to 1.5 800G optical modules and 2.15 400G optical modules, and each single H100 corresponds to about 20 100G optical chips.

2.4. In 2024, 800G will enter the stage of large-scale volume production, and the era of 1.6T is gradually approaching

The update iteration cycle of optical modules is about 3-5 years, and overseas manufacturers take the lead in deploying optical modules. The 400G increment began in 2019, and overseas cloud service providers deployed faster than domestic vendors. Amazon, Google, Microsoft, and Meta adopted a 100G/400G architecture and commercially deployed 400G optical modules within their ultra large data centers starting in 2019. Among domestic Internet manufacturers, short video companies have the greatest pressure on traffic growth and room space. In 2021, ByteDance will become the first domestic customer to purchase 400G optical modules in batches.

Driven by the demand for overseas AI computing power, the demand for 800G optical modules began to increase in March 2023, and the shipment of 400G orders increased in the second half of 2023. According to C114, due to factors such as data center demand and capital expenditure contraction, the market was originally expected to be pessimistic in early 2023. However, since March 2023, the company's overseas customers' demand for 800G optical modules began to increase, and orders continued to be added. The main driving force behind this was the demand for switch networks that matched AI computing power. In the second half of 2023, some overseas customers began to increase their demand for 400G optical modules for Ethernet 400G switch networks, and the company's 400G orders and shipments also began to increase significantly.

The technological upgrade of 800G optical modules includes three generations: 1) the first generation is 8 optical 8 electrical, with optical interface 8*100Gb/s and electrical interface *100Gb/s. It is also the earliest generation and was commercially launched in 2021; 2) the second generation is 4 optical 8 electrical, with optical interface 4*200Gb/s and electrical interface 8*100Gb/s. The commercial time is expected to be 2024; 3) the third generation is 4 optical 4 electrical, with optical interface 4*200Gb/s and electrical interface 4*200Gb/s. The commercial time is expected to be 2026. 8*100Gb/s is the mainstream solution for the early application market of 800G optical modules. When the single-channel electrical interface rate is the same as the optical interface rate, the architecture of the optical module will achieve the best performance, with advantages such as low power consumption and low cost. Therefore, 4*200Gb/s is the ideal architecture for 800G optical modules, and will also become the foundation for the implementation of 1.6 Tb/s in the future.